Be careful of e-Invoice! You might be the one who needs to issue e-Invoice in Phase 2!

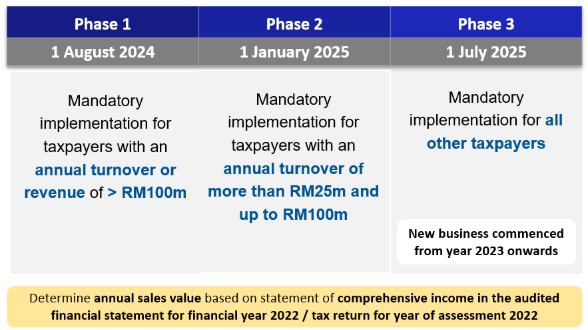

It has been months since the Phase 1 implementation of e-Invoicing, which required businesses with an annual turnover or revenue of more than RM100 million to comply. Now,

Phase 2 has begun, requiring taxpayers with an annual turnover or revenue of more than RM25 million and up to RM100 million to issue e-Invoices. Similar to Phase 1, a relaxation period will be provided to Phase 2 taxpayers as well. However, certain rules and regulations must still be adhered to, as non-compliance could result in penalties, including fines capped at RM20,000 or imprisonment for up to six months.

So, do you know what is allowed

during the relaxation period? Let’s see~

Businesses can choose to issue either e-Invoice or a consolidated e-Invoice. The difference between the two is that an e-Invoice is issued to each buyer, , while a consolidated e-Invoice gathers multiple invoices or receipts and issues them

in a single consolidated e-Invoice. Remember, you need to submit the consolidated e-Invoice within the 7th calendar day after the month end!

Timeline of e-Invoice implementation

Phase 2 of e-Invoicing will continue until the end

of June 2025, after which Phase 3 will commence. If your company falls under Phase 3, you might feel that e-Invoicing is still far off and that you have more time due to the relaxation period, which allows issuing consolidated e-Invoices for up to six months. However, it’s closer than it seems, as e-Invoicing is more complex than it appears. It’s essential to start preparing for e-Invoicing now!